Donate at www.matanbsayser.org.

Donate at www.matanbsayser.org.

Camp Gan Israel Registration and Open House Plus CGI Sports Camp

Visit www.cgibeachwood.com. More info on CGI Sports Camp.

“Cruises, Elective Surgeries, and Shabbos” – Kollel Nachlas Yaacov Yarchei Kallah, Monday, 1/1

Amazing End-of-Year Clearance Deals at Cleveland Auto Leasing Midwest!

Curves Women’s Fitness Center – Enroll Now – Call (216) 932-0900

Tip Tap Toe Winter Blowout Sale!

Take 2 Boutique Winter Clearance and Update!

Make a Year-End Donation to the Cleveland Eruv

Cleaning Special for Chimney Sweep, House Cleaning, Air Ducts, Carpet Cleaning, Upholstery and more!

My name is David Zilberman and I am happy to serve the Cleveland Orthodox Jewish community. Please call me at 216-512-2211 or 216-312-6371 with any questions or to arrange service.

My name is David Zilberman and I am happy to serve the Cleveland Orthodox Jewish community. Please call me at 216-512-2211 or 216-312-6371 with any questions or to arrange service.

Serving Cleveland and surrounding areas. Shomer Shabbat. Visit my website – www.greenandcleanhomeservices.com, see my reviews on www.homeadvisor.com, or https://www.google.com/search?q=%22Green+And+Clean+Home+Services%22#lrd=0x883102dd540c4297:0x7a494b84df85dd4b,1 (jobs referral sites).

Tip Tap Toe Winter Blowout Sale!

University Heights Mayor-Elect Brennan and Councilman Rach to be Sworn in January 2 – Weiss Encouraging Community to Attend

On January 2, 2018 Michael D. Brennan will be sworn in as the new City of University Heights’ Mayor. The swearing in ceremony will be held at 7pm at the Dolan Science Center at John Carroll University with a desert reception beforehand, including kosher items, requested by Mayor-Elect Brennan specifically for our community.

On January 2, 2018 Michael D. Brennan will be sworn in as the new City of University Heights’ Mayor. The swearing in ceremony will be held at 7pm at the Dolan Science Center at John Carroll University with a desert reception beforehand, including kosher items, requested by Mayor-Elect Brennan specifically for our community.

Councilwoman Michele Weiss is encouraging members of our community to attend to show our appreciation and to remain involved in directing our city’s future. She said “Our community was instrumental in electing Mayor Elect Brennan. Furthermore, this election demonstrated that every vote counts.”

More information about the event can be found on Facebook at https://www.facebook.com/events/145397712774018.

Kollel Nachlas Yaacov Raffle!

With your help we can continue to support our Kollel members who dedicate themselves to learning day and night. Thank you for being a partner!

To purchase tickets visit pay.banquest.com/KNYraffle.

Name Added to Tehillim List

Please daven for Yechezkel Binyomin ben Miriam Shoshana.

Please daven for Yechezkel Binyomin ben Miriam Shoshana.

(View the Cleveland Tehillim List.)

May we be zocheh to hear b’soros tovos b’korov!

Take 2 Boutique Winter Clearance and Update!

Kozuch Insurance Services – Auto, home, business , life and long term care

Time is Running Out! Donate to Matan B’sayser Before the Year’s End!

Donate at www.matanbsayser.org.

Donate at www.matanbsayser.org.

“The Whys and Hows of Budgeting” – Presented by Stacey Zrihen, Senior Advisor of the Achiezer Financial Management Program

The Cleveland Chesed Center, in partnership with Gesher and JFSA, are working to bring financial literacy educational opportunities to Cleveland Families.

The Cleveland Chesed Center, in partnership with Gesher and JFSA, are working to bring financial literacy educational opportunities to Cleveland Families.

We are happy to announce our first workshop, “The Why’s and How’s of Budgeting” on January 9th, 2018, from 8:30 – 9:30pm at Heights Jewish Center.

Educational Choices: Discover the Scholarship That’s Right for Your Child

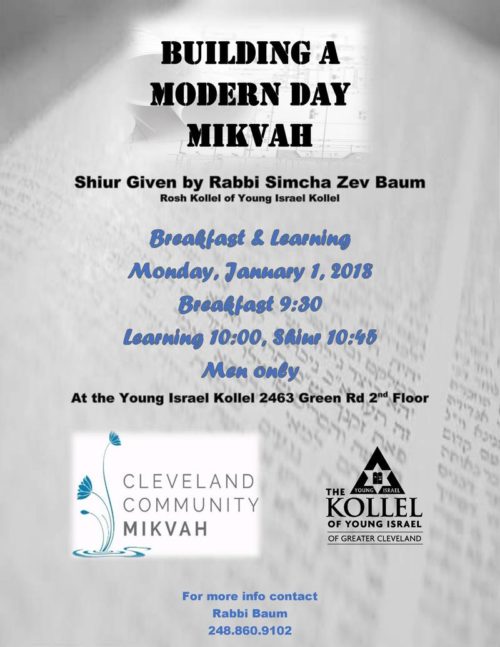

Mikvah Event at Young Israel Kollel Monday Morning

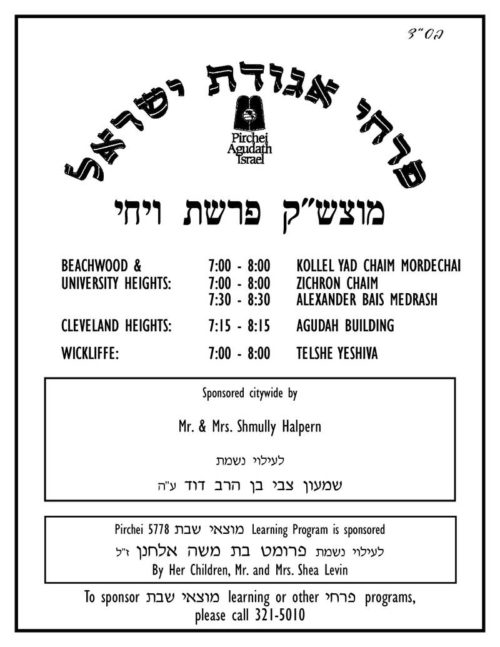

Pirchei Motzei Shabbos Chanukah, Parshas Vayechi

Jump Into Camp Chaverim! Early-Bird Discount Ends this Sunday!

If you sign up by this Sunday, Dec. 31st, new campers save $150! Returning campers save $200!

WHY CHAVERIM?

The activities are incredible: A professional laser tag arena on site! Organized sports program! Amazing weekly trips! Professional instructors in golf, and woodworking! Fully stocked lake for fishing bass AND MORE!

Our learning program is serious, but never boring. Our expert Rebbeim help campers learn how to “make a laining” on select pieces of Gemara and campers get to learn Halachah in hands-on workshops such as Safrus and Esrog Checking. Chaverim counselors are carefully selected top talent that exhibit exceptional middos and a whole lot of energy! Last but not least, מדות בין אדם לחבירו doesn’t just happen in camp, we make it happen!!!

TO APPLY & FOR MORE INFORMATION, CHECK OUT OUR WEBSITE!

WANT TO SEE WHAT WE MEAN IN UNDER 4½ MINUTES?

Step #1: Buckle your seat belt

Step #2: Turn the volume to high

Step #3: Press play and enjoy the NEW Camp Chaverim video below!!!!!

Dave’s Electric – Leave it to Us

Visit us at www.Daves-Electric.com or email info@daves-electric.com.

Visit us at www.Daves-Electric.com or email info@daves-electric.com.

Amazing End-of-Year Clearance Deals at Cleveland Auto Leasing Midwest!

A New, Tax-Advantaged Opportunity for Yeshiva Parents – The Updated 529 Account Plan: a Developing Story

Download the information about 529 Accounts below as a two-page PDF from Agudath Israel.

Download the information about 529 Accounts below as a two-page PDF from Agudath Israel.

1. What is a “529” plan?

A 529 plan is a special, tax-advantaged account designed to encourage saving for college (including certain post-secondary yeshivos). The federal tax advantage is that earnings on funds contributed to 529 accounts are not federally taxed.

Example: Parent deposits $1,000 into Child’s 529 account at Child’s birth. The 529 account is worth $2,500 when Child attends college. If the $2,500 is properly used to pay college expenses, there is no federal tax on the $1,500 earned.

2. Are there any benefits to 529 plans at the state level?

Yes! In many states, the principal contributed to the plan is deductible for state income taxes. State laws on this point vary widely.

Example: Ohio parent deposits $2,000 into child’s Ohio 529 account to save for college. If parent’s income was $100,000 that year, after the deduction, Ohio will view that income as $98,000. Ohio allows a deduction from state taxes up to $2000 per beneficiary. The amount of savings will depend on the filer’s state income tax rate and the number of beneficiaries for which they contribute.

3. Any there other potential 529 benefits?

Yes. Upromise, a Sallie Mae company, offers automatic deposits to 529 accounts, at no cost to account holders, of up to 5% of retail, travel, and other purchases paid for by a Upromise linked credit card. These free contributions may not be game-changing, but they add up.

Also, the existence of a tax-advantaged account, with potential tax advantages for contributors, provides an address, and incentivizes assistance, from friends or family who may not have otherwise assisted.

4. Why are you telling me this? What’s changed?

While 529 accounts have been available for use toward paying college expenses for decades, effective 1/1/2018, federal law expands the allowable use of 529s to include K-12 expenses.

5. What does that mean for me, a yeshiva parent?

In addition to being a significant, symbolic, national school-choice victory, encouraged by Agudath Israel and other nonpublic school groups as part of our tax advocacy efforts on the federal level, it means that a new, beneficial vehicle will be available to help plan for the tremendous expense our community bears in paying yeshiva tuitions. Parents (and others) can set up and deposit money in 529 accounts, have that money grow, federally tax-free, and use the funds for K-12 yeshiva tuition.

6. You said that a change occurred at the federal level to expand 529s to K-12 expenses. What does that mean for the state deduction opportunities mentioned?

That is a critical question now. If allowed, this would be of further assistance to yeshiva parents. K-12 state deductibility would allow parents to attain long-term (federal) benefits, and more immediate (state) benefits.

Caveat #1: States have not yet legislatively reacted to the new federal law. Some states may adjust their laws to favorably embrace K-12 expenses to complement their existing college savings deduction benefits, others may not. Ohio law, currently, would seem to not allow a deduction for K-12 expenditures. Agudath Israel is actively working to address this for the 2018 tax year.

Caveat #2: Benefit specifics vary widely from state to state. For example: in Ohio contributions, including rollover contributions, to a Ohio 529 plan of up to $2,000 per beneficiary per year (any filing status) are deductible in computing Ohio taxable income, with an unlimited carry forward of excess contributions. Contribution deadline in Ohio is December 29. New York has a maximum deductible amount of $10,000 per year for married filing joint filers. New Jersey offers NO state tax deduction, although it does offer a matching college scholarship program for 529 deposits. (More on that coming soon from Agudah’s NJ Director, Rabbi Avi Schnall.) Colorado offers unlimited deductions for 529 contributions. States like Florida or Texas, that have no state income tax, obviously do not offer state tax deductions.

Excellent overview of state tax benefits, limitations, and application links here.

7. Can I realize a state tax deduction even if I need to use the money sooner than expected?

The greatest tax benefit will come from keeping funds in the 529 account for a longer period of time, so growth occurs federally tax-free. However, it is possible to realize the state tax benefit, if applicable, even if funds are withdrawn for K-12 tuition sooner, if the state-specific holding period is complied with. Check with your tax advisor for details.

8. What is the Agudah doing about this now?

Agudah is engaged in a coordinated, multi-state approach on this issue, following the successful K-12 expansion at the federal level. The multi-pronged approach includes:

- Advocating that states which do not currently off er a state 529 benefit, now introduce one.

- Advocating that states embrace the new, broader federal definition of 529s which encompasses K-12 expenses.

- Defensively moving to protect 529s at the state level from current efforts to limit its applicability, in response to a change in the federal law that states may not have sanctioned.

- Advocating to raise annual deduction limits and streamline other plan limitations. After all, given the new federal guidelines, significantly more savings, and thus more deposits, are necessary for a parent to save for K-12 and college tuition than for college tuition alone.

9. What can I do?

- Stay tuned for updates from us and other sources on this developing issue.

- Consult with your personal accountant or financial advisor to determine if a 529 account is appropriate for you.

- We have opened a dedicated inbox – 529@agudathisrael.org – for comments on this issue. Due to the volume of submissions expected nationally, we intend to read every comment, but you will likely not receive a response beyond an automated acknowledgment. This mailbox is NOT designed to be a forum for individual tax questions.

- You can always contact Agudah’s Ohio director, Rabbi Yitz Frank at YFrank@agudathisrael.org with questions.

Top 4 questions to ask your tax advisor now:

- Is a 529 account right for me?

- What are the specific benefits and limitations of 529 accounts in my state?

- Is there an advantage to opening or contributing to a 529 account in the closing days of 2017?

- What is the interplay between 529 contributions and gift tax limits?

The above is not considered tax advice of any kind. Please consult with your tax advisor to determine your best course of action.

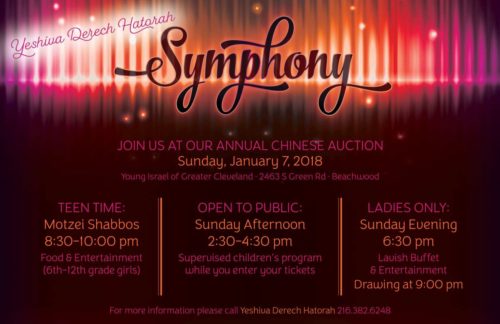

Yeshiva Derech Hatorah Presents “Symphony” Annual Chinese Auction, January 7th!

Time is Running Out! Donate to Matan B’sayser Before the Year’s End!

Donate at www.matanbsayser.org.

Donate at www.matanbsayser.org.

Amazing End-of-Year Clearance Deals at Cleveland Auto Leasing Midwest!

Make a Year-End Donation to the Cleveland Eruv

Grand Judaica Post-Chanukah Sale! Up to 30% Off!

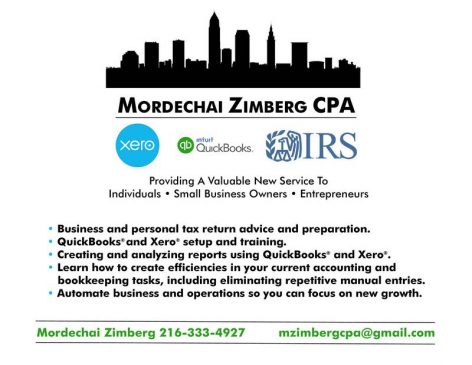

Tax and Accounting Services

- « Previous Page

- 1

- …

- 708

- 709

- 710

- 711

- 712

- …

- 1318

- Next Page »